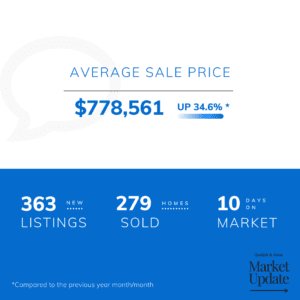

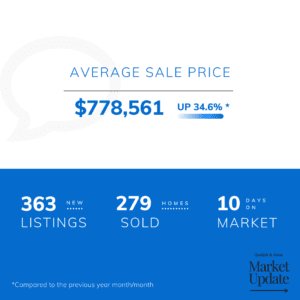

MAY MARKET REPORT:

Compared to May 2020 you can see our numbers are rising for yet another month this year. I do not see the average sale price decreasing at all in 2021 but I do predict the rate at which it is climbing to level out in the coming months. One reason for this is the change in mortgage rates.

The department of finance has announced at as of June 1st insured mortgages will be given the same stress test as uninsured mortgages. The stress test for both will either be the current rate plus 2% or 5.25%, whichever is greater.

With these tighter rules, what does this mean for you? These new rules are in place simply to protect borrowers in the event of mortgage rates rising, which of course they inevitably will given the current low rate. This will not make a huge impact on borrowing but we encourage you to reach out to a mortgage specialist for more details and information.

Only time will tell if this will impact our strong market in Guelph. I predict over the summer we will see the market soften and see less competition and more reasonable sales numbers. With the stress test now in place, it can affect borrowing power by 3-4% which could ultimately change people’s decision to move.

Stay cool,

Nick