This fall brings encouraging news for anyone thinking about entering the housing market or making a move. With lower borrowing costs and new incentives for first-time buyers, Ontario is creating a more accessible path to homeownership. Here is a look at the latest updates and how they may shape the months ahead.

Bank of Canada Lowers Interest Rate

In October 2025, the Bank of Canada reduced its overnight rate by 25 basis points to 2.25 percent. The Bank Rate is now 2.5 percent and the deposit rate is 2.20 percent. This shift makes borrowing more affordable and helps ease overall mortgage costs.

Buyers with variable-rate mortgages may see savings right away, and new buyers entering the market could qualify under more favourable conditions. The next rate announcement is scheduled for December 10, 2025.

New Incentives for First-Time Buyers

The Ontario government has introduced a new rebate for first-time buyers of newly built homes valued up to one million dollars. Eligible buyers can save up to 80,000 dollars through the provincial portion of the HST rebate. When combined with the federal rebate, total savings can reach as high as 130,000 dollars.

At a time when affordability is top of mind, this program gives first-time buyers a meaningful advantage as they work toward purchasing their first home.

October Market Update

October brought a steady and balanced picture across Wellington County. While sales activity varied by community, pricing remained stable in most segments, showing a market that is adjusting but not losing momentum.

By the Numbers

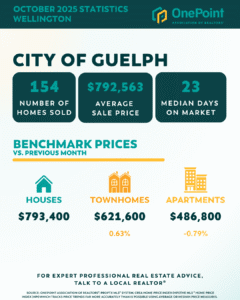

Guelph:

Guelph saw strong movement this month with 154 homes sold. The average sale price reached 792,563 dollars. Detached homes held steady with a benchmark price of 793,400 dollars, while townhomes saw a modest increase of 0.63 percent. Apartment prices dipped slightly, down 0.79 percent from last month.

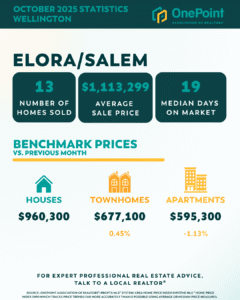

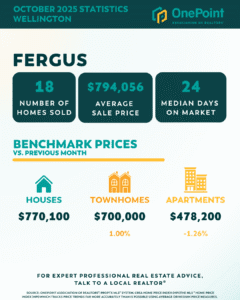

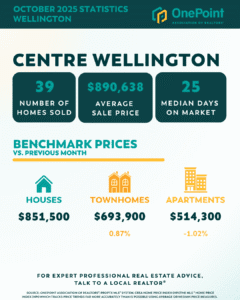

Centre Wellington:

Centre Wellington recorded 39 sales in October, with an average sale price of 890,638 dollars. Detached homes remained stable at a benchmark of 851,500 dollars. Townhomes led growth with an increase of 0.87 percent, while apartment benchmarks softened slightly, down 1.02 percent.

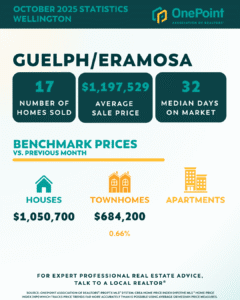

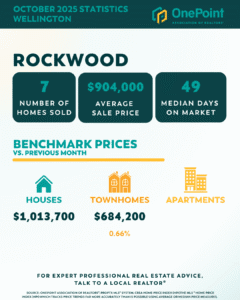

Rockwood:

Rockwood saw 7 sales this month with an average sale price of 904,000 dollars. Detached homes averaged 1,013,700 dollars. Townhomes posted a 0.66 percent increase, bringing the benchmark to 684,200 dollars.

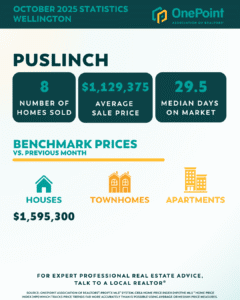

Puslinch:

Puslinch reported 8 sales and an average price of 1,129,375 dollars. Detached homes continue to command higher price points, with a benchmark of 1,595,300 dollars.

Days on Market

Homes in Guelph sold in a median of 23 days, showing consistent confidence among active buyers.

Centre Wellington properties averaged 25 days on the market.

Rockwood saw slower movement, with a median of 49 days.

Puslinch homes took a median of 29.5 days, reflecting a more deliberate pace in higher price rural properties.

What This Means for You

Buyers:

Stability in pricing combined with the recent rate drop gives buyers more opportunity this fall. Townhomes across all communities continue to offer strong value, and slight softening in apartment benchmarks may create new openings for first-time buyers.

Sellers:

Detached homes remain steady performers throughout the region. With motivated buyers still active, presenting your home well and pricing strategically are key to attracting the right interest quickly.

The Bottom Line

The market is settling into a balanced fall season. Sales remain consistent, prices are holding, and buyers are taking a thoughtful approach. Detached homes continue to show resilience, while townhomes and condos offer accessible entry points for those looking to make a move.